Incentive schemes act as a strategic tool to align salesperson’s behaviour with business objectives. It acts as a catalyst to motivate the salesforce. Incentive Compensation is the primary tool to differentiate between salespeople based on performance and helps retain top performers by clearly calling them out. It also plays a significant role as part of the total compensation structure and acts as a lever to attract top talent.

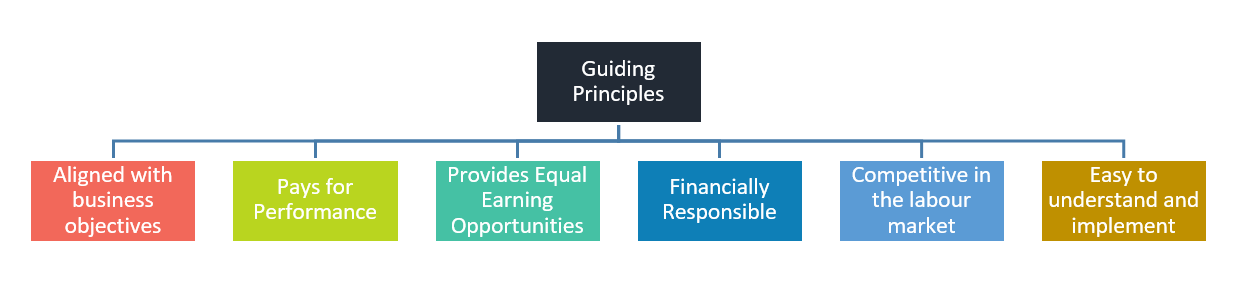

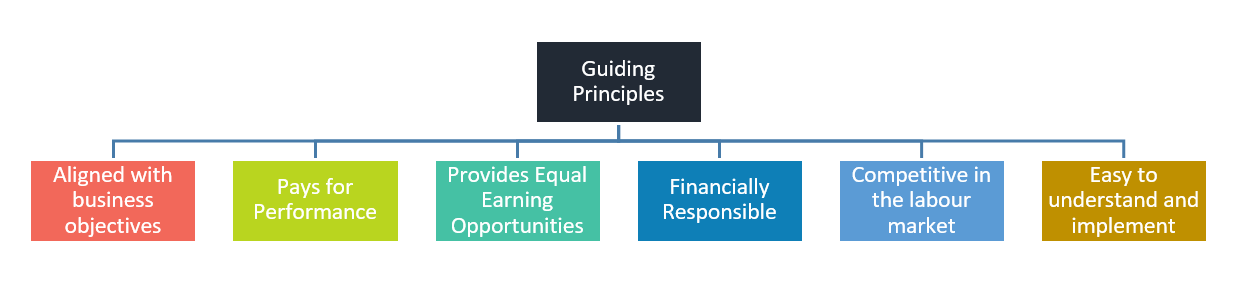

Guiding Principles

What are the guiding principles that drive the structure and definition of an incentive plan?

- Is it aligned with the desired business objectives? For example, does the plan drive the right customer segments to be targeted?

- Does it pay for performance? For example, are the salespeople being paid for activity only or for capturing market share/volume growth?

- Is it fair insofar as it provides equal earning opportunities to all salespeople irrespective of their geography, market potential, etc.? For example, are the salespeople with larger geographic territories inherently at an advantage?

- Is it financially responsible? For example, Is the final payout expected at the national level in line with the expected achievement with respect to the national forecast?

- Is the pay competitive in the current labor market? For example, does it retain top performers?

- Is the plan easy to understand for the sales force? Can this plan be executed using existing IT infrastructure and can a fully automated process be defined for successful operations?

There are inherent counteracting pressures between these guiding principles.

- Need for the incentive plan to be simple to understand but also remain fair

- The Incentive plan should be engaging but at the same time it should be financially responsible

- The Incentive Plan should support underlying business objectives but at the same time be manageable

- The incentive plan should be implemented with flexibility for future needs but the implementation should be fast and cost-effective

Design Framework

Given these guiding principles, what design framework components are important to consider while defining an Incentive Plan?

Total Target Compensation

How much should a salesperson be paid in total? What should be the total compensation structure including base salary and potential incentive payouts? The organization’s compensation philosophy, in general, has a large bearing on this element. Defining the TTC depends on how much the organization weights compensation as part of its value proposition to its employees. It is also important to review industry TTC benchmarks for competitiveness and clearly define the organization’s desired market position. This will help ensure that organization is able to attract and retain the right type of people.

Salary-Incentive Pay Mix

What should be the ratio between base salary and incentives viz. the pay mix? The pay mix depends on the extent to which the salesperson is responsible for the final sale. For eg. Real Estate agent pay mix leans towards higher incentives because the sales are almost fully determined by salesperson capability. Sales Support roles usually tend towards having a higher base salary in the mix because of their lower ability to impact the actual sale. Organizations that don’t have adequate availability of data or confidence in the measurement of performance also tend to weigh incentives less. The pay mix should ensure that the total expected compensation remains motivational and yet financially responsible. The pay mix also plays a big role in signaling the type of salespersons to attract to that role.

Portfolio Definition

What portfolio of brands should you focus on for each salesforce? One may choose to group all brands sold by that salesforce into one basket and measure on that. Alternatively, one may choose to provide one incentive scheme to certain key brands that need special focus and one incentive scheme for all brands sold by that salesforce. Some organizations may choose to focus on certain individual brands sold as well and measure each brand’s performance separately to maintain higher focus. The portfolio definition decisions are driven by the organization’s business strategy, the brand focus they’re hoping to achieve. Fine-tuning portfolio definition helps sharpen the focus on which brands the organization wants to push more.

Performance Metric Definition

Once portfolios have been appropriately defined, the next step is to define the metrics that define performance. What are the KPI’s that the business manages around and how can those KPIs be rolled down to sales performance metrics? Should a combination of metrics be used? The metric should be chosen such that it supports the desired business strategy. Factors that affect the type of metric chosen are the sales channel, the reliability of sales data and brand maturity. Ideally, one incentive plan should have no more than three plan metrics. A good metric should be clearly measurable and specific with significant weight associated with it (>15% of total target). There should be clear guidelines in terms of expectations from primary product as compared to other products in the portfolio. For example, a growth stage brand may be assigned a volume growth metric but a mature brand may be assigned a volume metric based on the organization's business objectives.

Plan Type Selection

What sort of an incentive scheme should you choose? Should it be goal-based to measure against predefined targets? Should it use a matrix type scheme type to measure performance against two metrics simultaneously? The selection should be based on the organization’s specific needs and the way it prioritizes the different guiding principle. For e.g – fairness vs. simplicity, motivation vs. financial budget. Other factors that need consideration such as data reliability, confidence in national sales forecast, variation in territory potential etc. For example, if the confidence in national sales forecast is low, a goal-based scheme is not ideal. If variation in territory potential is high a commission against volume plan type is not ideal.

What should the design of the payout curve assigned to the component? Curve aspects like the threshold, cap, kickers and multipliers should be considered? For example, Does your organization believe in paying incentives starting at 80% target achievement or only at 100% target achievement? At what performance should you consider a multiplier to motivate top performers more? How would my curve perform financially against an unexpected higher national performance? Should I cap top performer payouts at a point to guard against outlier performances? Industry standards also play a role to some extent in defining the upside and downside risk depending on organization’s market positioning.

Performance Measurement Period Definition

The incentive period definition also plays an important role in incentive plan design. What is the measurement period I should use for my incentive plan – Annual, quarterly or monthly? How often should I pay my reps? If a rep underperforms in earlier months, should I offer a chance to catch up by the end of the year? When should I run incentive calculations with respect to the end of the measurement period? These depend mostly on data reliability, expectations from the salesperson, system capability and the importance of meeting shorter-term national forecasts vs. annual national forecasts. Another important factor to be considered is the application of interim payout caps in case the performance measurement period is larger than the payout frequency.

All the above attributes play a significant role in the overall success of an IC plan. The qualitative impact of an ineffectively designed plan is well recognized but companies fail to take into account the financial implications (of increased attrition rate, lower morale, lost selling opportunity due to higher shadow accounting and dispute resolution time, higher administration cost) of poorly designed incentive plans and don’t put enough emphasis into balancing the inherent counteracting pressures in the guiding principles.