What do top salespeople do differently? Can we analyse the behaviour of top performers using sales performance data to identify traits that can be used for coaching lower performers? There is a lot of literature on how to improve salespeople's efficiency by focusing on the softer aspects of sales coaching. What if there's behaviour that top performers indulge in without knowing it themselves? Maybe the data can talk to us.

Let's take the example of a software firm. It sells three different types of products with the option of attaching services to each of those products. These products are non-competing, so multiple products can be sold to the same customer. Let's say these products are an anti-virus solution, a firewall solution and an anti-malware solution. In short, we'll call them AV, FW and AM. Each of these product lines also has different flavours, which are progressively priced. For, eg., anti-virus solutions may have a home, SMB and enterprise editions.

Define Performance

First, let's define performance. Without defining performance appropriately, how do we know who are the top performers? All the salespeople have assigned quotas and hence we're going to simply use revenue achievement to quota as our performance measure. Hence people with high revenue achievement are top performers. Let's quintile all the reps on the basis of revenue achievement and place them in the 5 quintile buckets.

We have identified our top performers. Let us now look at different types of analyses on the performance data of the top two quintiles to understand behaviours that set them apart from the rest of the salesforce.

Portfolio split

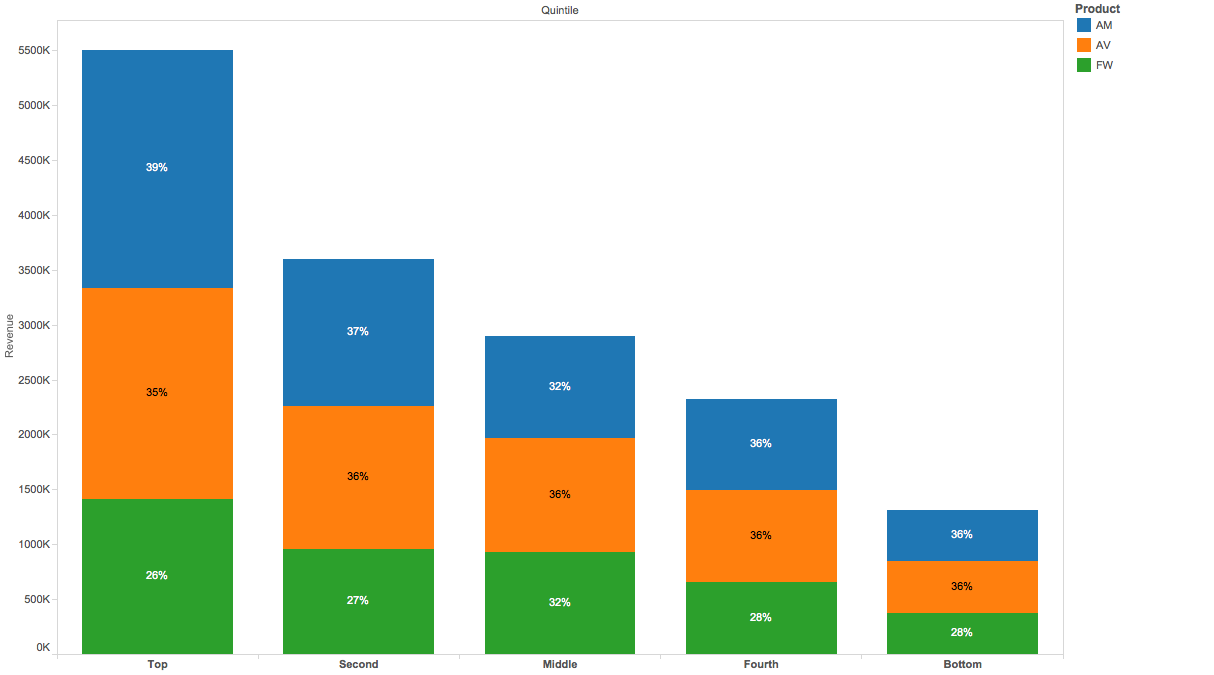

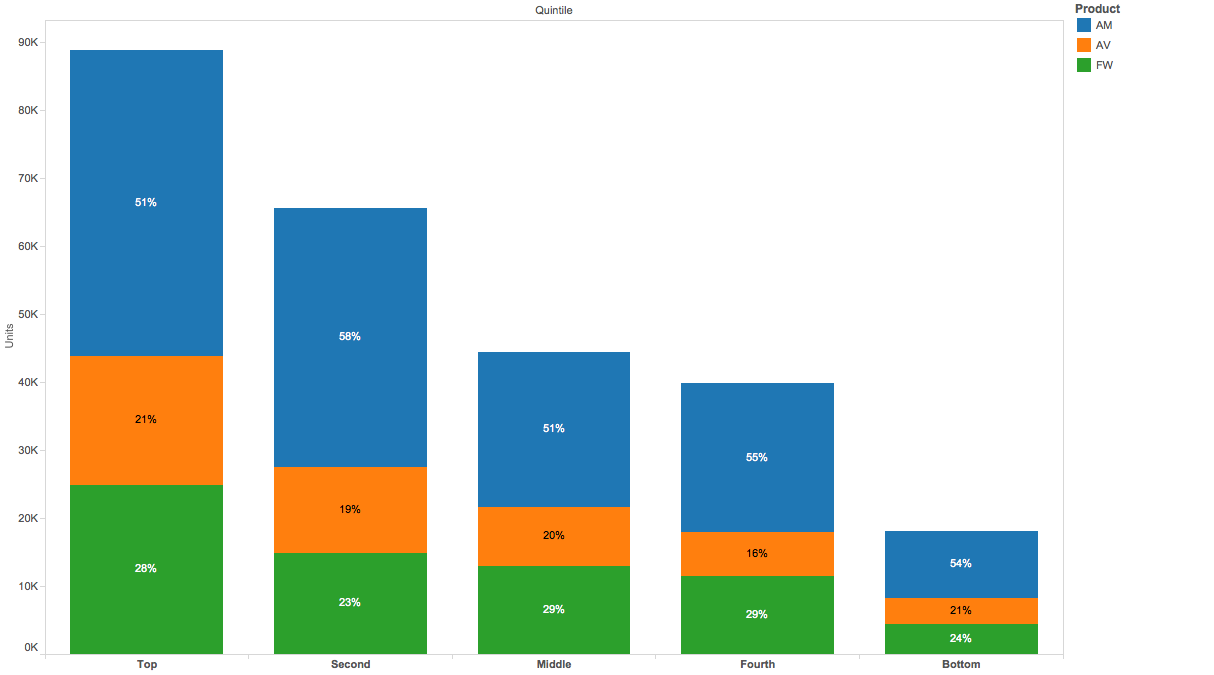

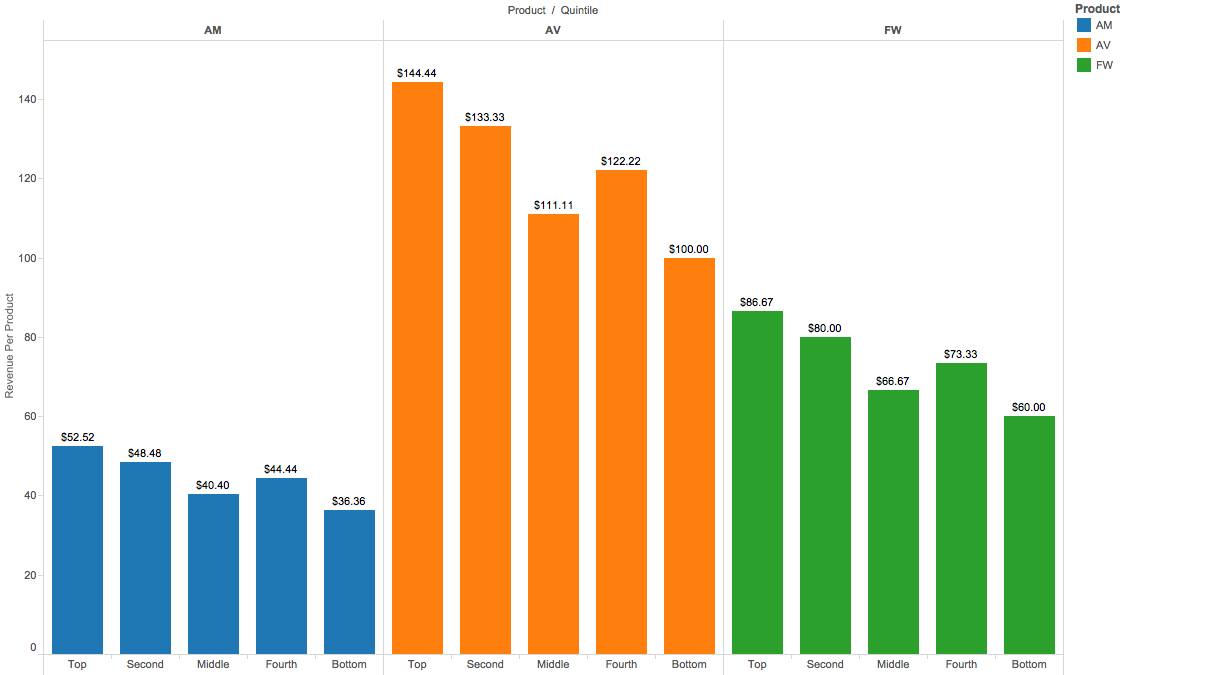

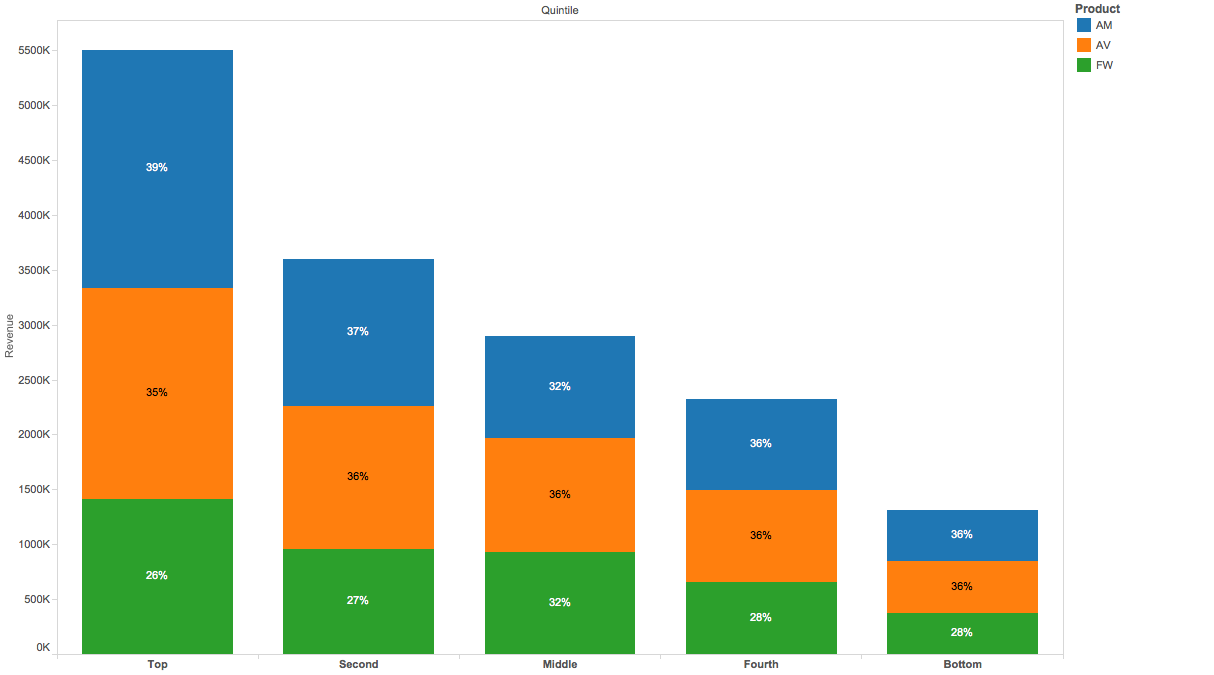

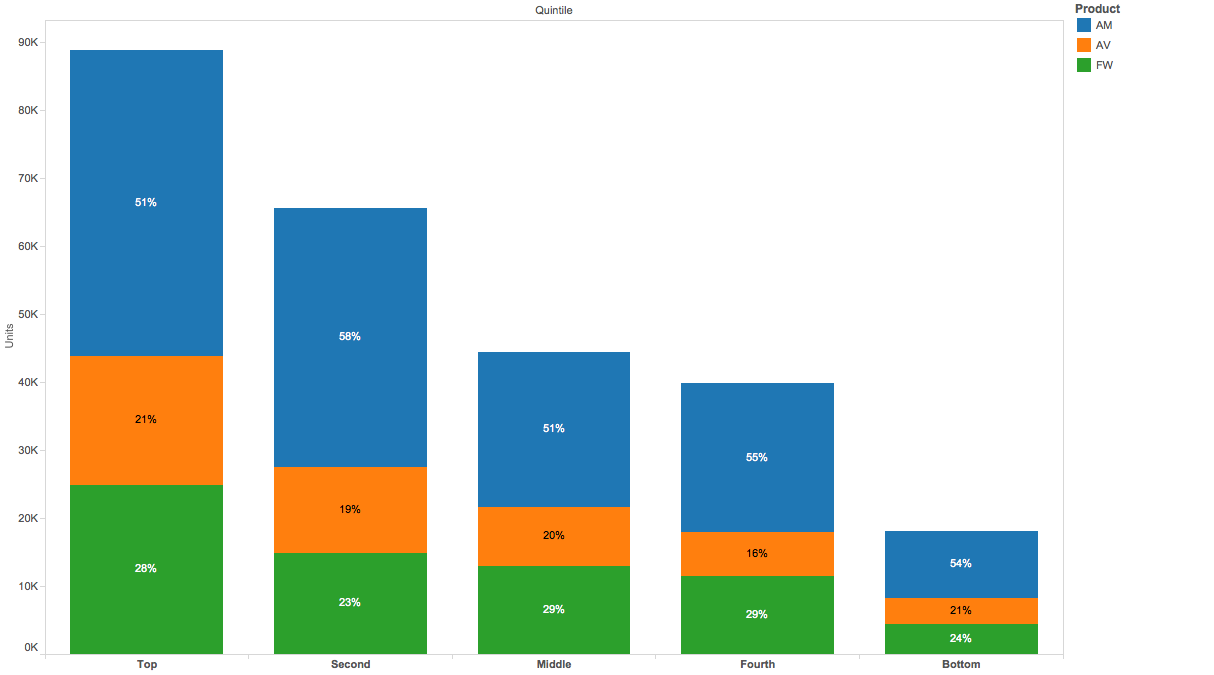

First, let's analyze the split of product sales by quintile, both in terms of units sold as well as revenue dollars.

Product split by quintile (Revenue)

Product split by quintile (# of units)

There is some variation in the split of product sales by quintile. The absolute units and revenue are much higher in the top quintile (which is obviously expected). However, there doesn't seem to be a distinct trend to suggest that the top performers favour one product over the other. Hence there doesn't seem to be any significant behavioural trend on the product portfolio split.

Cross-selling

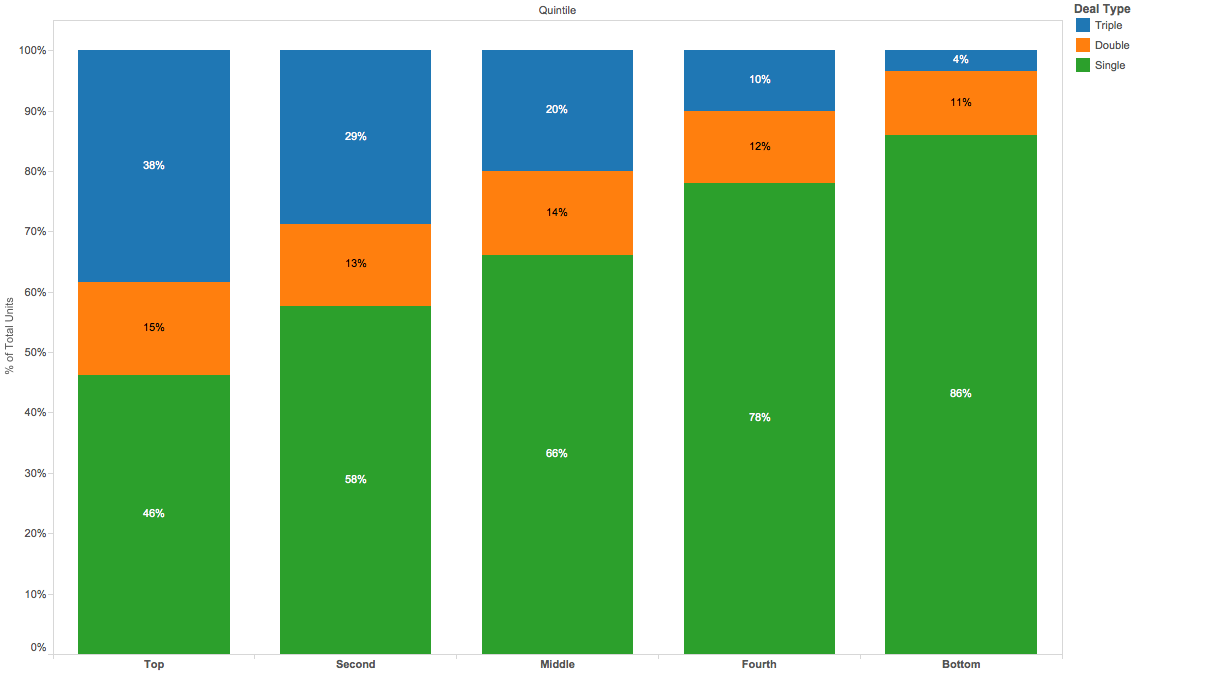

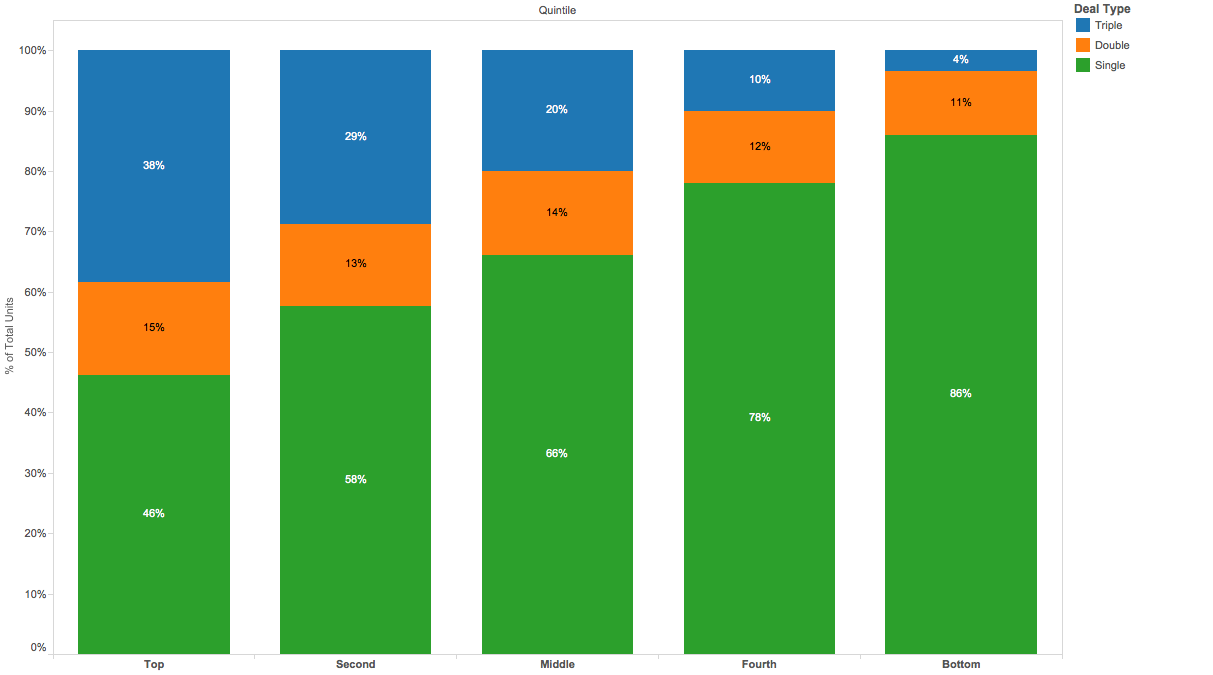

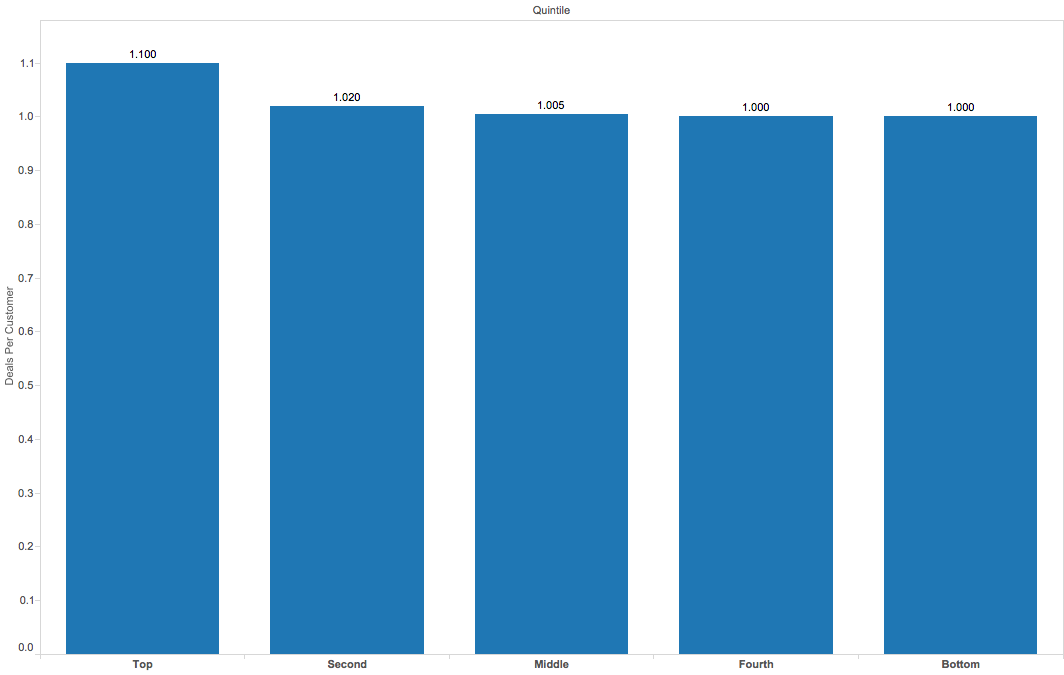

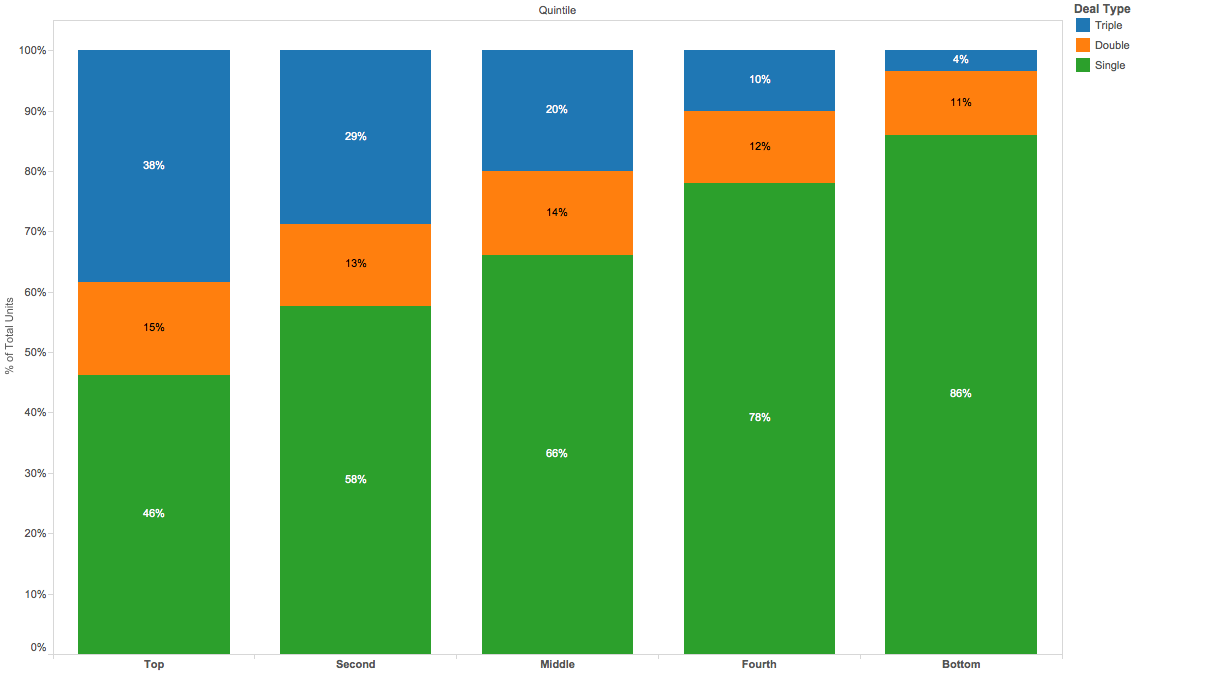

Do top performers sell more products on average to the same customer? This is commonly known as cross-selling. Let's take a look at the split of one product deals, two product deals and three product deals sold by performance quintile.

Multi-product deal split by quintile

Now there's a trend! It seems the top performers tend to sell multiple products to every second customer. It's distinctly clear that the lower performers tend to sell much more single-product deals than the top performers. There may be additional opportunities within their converted prospects that they may be leaving on the table. Hence if we encourage, incentivize and train our lower performers to do more cross-selling and ask the right questions to their prospects to uncover extra opportunities, we can improve our overall sales performance. The company's marketing department can also probably offer some customer discounts on second and third products in the same order to encourage this behaviour further.

Upselling

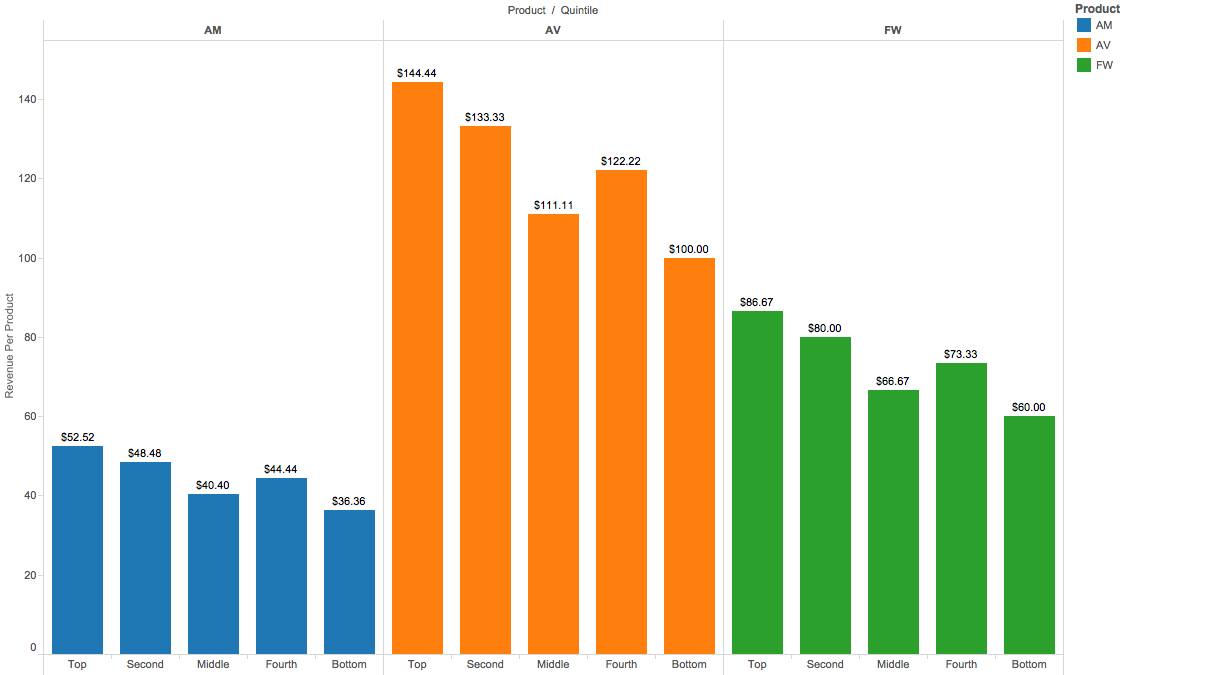

Are the top performers selling higher revenue product flavours as compared to the lower performers? Let's take a look at the average revenue per product line per customer. That should give us a good view of this behaviour.

Average revenue per product line per customer by quintile

Hmm. It seems that the top performers are selling higher revenue product flavours as compared to the lower performers. Note that due to pricing differences between products comparing the average revenue levels between products is irrelevant. It's not as significant a difference as the multi-product split, but a trend exists to suggest better up-selling by the top quintiles. Hence there is some advantage for the company to gain by improving coaching and incentivizing up-selling. Certain types of discretionary manager-approved customer offers can also help this trend along.

Multi-location deals

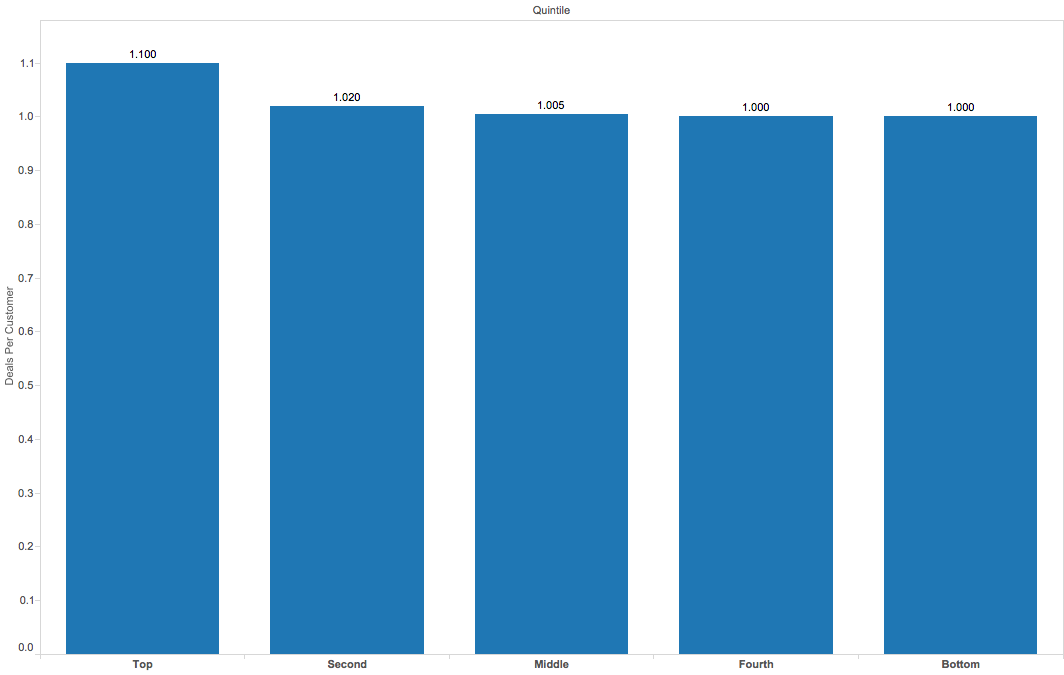

Are top performers selling to larger corporate groups? This is a more pronounced possibility in SMB sales. Many times the owner of one Mcdonald's actually owns a set of franchises. This is especially possible in the franchise business. This offers the possibility of making one sales pitch and capturing several orders at once. Let's look at the average number of orders per customer by quintile. Note that this may not be straightforward to analyze if your sales systems define an order as unique to one customer. It may require some special data-cleansing/mining to identify customer name patterns to identify them as the same customer.

Average orders per customer

So it seems about 1 in 10 customers that the top quintile sells to is a multi-location deal. This trend can be exploited by the company and help train the salespeople to inquire with their prospects about other businesses that they may own. Again marketing can play a role here by incentivizing customers to purchase company products for all their businesses by offering discounts or some free services on multi-location deals.

Additional thoughts

We have only skimmed the surface with the analysis that we've done. For larger salesforces, there may exist clusters of top performers within the top quintile that behave differently. For example, one cluster may go for volume and maximize their deal counts, whereas another cluster may spend more time with the customer to sell higher revenue flavours. Their revenue achievement to goal performance may be the same, but their path to get there may be different. Identifying such clusters can help in further understanding top-performer selling behaviour and help in driving coaching requirements. Additionally, for larger salesforces, it may be beneficial to decile performance rather than use quintiles. This helps isolate the top performers into a smaller sample and enhances the visualization of trends.

Incentius can analyze your sales data and identify such behaviours that can help your company push sales performance.

Would you like to get a sample analysis of your sales data for your company? Please email us at info@incentius.com

And if you got this far, we think you’d like our future blog content, too. Please subscribe on the right side at Incentius.